Welcome to our comprehensive guide on the best investment advisory services! In today’s dynamic financial markets, having expert guidance and recommendations is essential for investors looking to optimize their portfolios and achieve their financial objectives. That’s where top-rated investment advisory firms come in. These premier investment consulting services, provided by leading investment management companies, offer personalized investment strategies, risk management expertise, asset allocation advice, and portfolio monitoring solutions.

As the investment landscape evolves, new trends emerge. Sustainable and socially responsible investing has gained momentum, reshaping the market. Retirement planning, tax optimization, and estate planning are also integral areas of focus for investment advisory services. Whether you’re a seasoned investor or just starting, uncovering the best investment advisors is crucial for your success in financial markets.

Key Takeaways:

- Expert guidance from the best investment advisory services is essential for achieving financial success.

- Top-rated investment advisory firms provide personalized strategies, risk management, asset allocation, and portfolio monitoring.

- Sustainable and socially responsible investing is shaping the investment landscape.

- Retirement planning, tax optimization, and estate planning are important areas of focus for investment advisors.

- Choosing the right investment advisory services is crucial for optimizing your portfolio and achieving your financial goals.

The Importance of Investment Advisory Services

Investment advisory services play a crucial role in helping investors navigate the complexities of financial markets. With their expertise and market insights, investment advisors assist clients in making informed decisions and capitalizing on investment opportunities. These services provide personalized guidance tailored to individual investor needs, ensuring effective asset allocation and risk management. The importance of investment advisory services is evident in their ability to guide clients towards achieving their financial goals and long-term success.

Investment advisors are valuable resources for investors seeking the **best investment advisory services**. They have in-depth knowledge of various investment options and can analyze market trends to identify potentially profitable opportunities. By staying up-to-date with the latest developments in the financial industry, investment advisors can provide valuable advice on **leading investment management companies** and strategies that align with clients’ financial objectives.

One of the key advantages of working with investment advisors is the personalized attention they provide. These professionals take the time to understand each client’s unique financial situation, risk tolerance, and investment goals. By tailoring their recommendations to individual needs, investment advisors ensure that clients’ investment portfolios are aligned with their specific objectives. This personalized approach sets them apart as **premier investment consulting services**.

“Investment advisory services provide personalized guidance tailored to individual investor needs, ensuring effective asset allocation and risk management.”

Expertise in Asset Allocation and Risk Management

Asset allocation and risk management are critical elements of successful investing. Investment advisors have extensive expertise in these areas and can help clients optimize their portfolios. By considering factors such as the client’s investment goals, risk appetite, and time horizon, investment advisors develop a well-diversified investment strategy that balances potential returns with the associated risks. Through regular portfolio monitoring and adjustments, advisors ensure that investments remain aligned with clients’ objectives even as market conditions change.

One of the primary benefits of investment advisory services is the peace of mind they offer. Investors can rely on the expertise of their advisors to help them navigate the ups and downs of the financial markets. By having a trusted partner who can provide guidance during challenging market conditions, investors can make more informed decisions and avoid emotionally-driven investment choices.

The Role of Technology in Investment Advisory Services

Technology has transformed the investment advisory landscape, enabling more efficient and accessible services. Many investment advisory firms now offer online platforms that provide investors with real-time access to their portfolios, performance metrics, and market insights. These platforms also feature intuitive tools for goal tracking, financial planning, and risk assessment, empowering investors to stay informed and engaged in their financial journey.

Investment advisory services leverage technology to streamline administrative tasks, allowing advisors to focus on building meaningful client relationships. Through the use of sophisticated algorithms and data analytics, advisors can analyze vast amounts of financial information and identify potential investment opportunities. This technology-driven approach enhances the capabilities of investment advisors and enables them to deliver **top investment advisory services**.

| Benefits of Investment Advisory Services | Advantages |

|---|---|

| Expert guidance tailored to individual needs | Ensures effective asset allocation and risk management |

| Access to market insights and investment opportunities | Helps investors capitalize on potential returns |

| Peace of mind during market volatility | Guidance from professionals during challenging times |

| Convenience and accessibility through technology | Online platforms provide real-time access and tools |

Investment advisory services are essential for individuals and businesses seeking to make informed investment decisions and achieve their financial objectives. With their expertise, personalized guidance, and use of technology, investment advisors empower clients to navigate the financial markets effectively. By partnering with a trusted advisory firm, investors can benefit from the **best investment advisory services** available, ensuring long-term success and peace of mind.

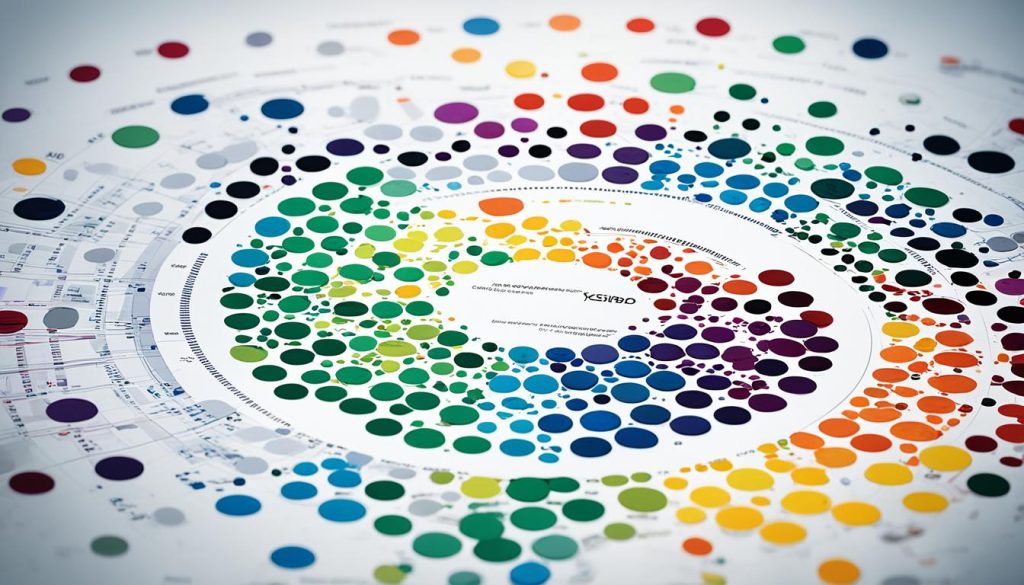

Segmentation of the Investment Advisory Service Market

The investment advisory service market is a diverse landscape that caters to different client needs, investor profiles, and service delivery models. By segmenting this market, top-rated investment advisory firms can adopt targeted strategies to provide premier investment consulting services and serve their clients’ unique requirements. Let’s explore the key segments in the investment advisory service market:

1. Client Needs:

Investors have varying financial goals and risk appetites. Premier investment advisory firms understand this and offer tailored services to meet specific client needs. Whether it’s wealth preservation, capital growth, or income generation, best investment advisors design investment strategies that align with individual client objectives.

2. Investor Profiles:

Investment advisory services cater to different types of investors, including retail investors, high-net-worth individuals (HNIs), and institutional clients. Top-rated investment advisory firms have expertise in managing portfolios for each of these investor profiles, providing the necessary guidance and insights to optimize investment returns.

3. Service Delivery Models:

The investment advisory service market offers a range of service delivery models. Traditional face-to-face advisory services allow clients to have direct interaction with their advisors, fostering personal relationships and a deeper understanding of their financial goals. However, with advancements in technology, top investment advisory services are also adopting digital platforms and technology-driven solutions, enabling clients to access investment advice and services conveniently and efficiently.

4. Specialization in Asset Classes and Investment Strategies:

Some premier investment consulting services specialize in specific asset classes or investment strategies, such as equities, fixed income, or alternative investments. This specialization allows investors to benefit from in-depth expertise and insights in a particular area, enabling them to make well-informed investment decisions.

These segments contribute to the diverse and dynamic investment advisory service market, offering investors a wide range of options when selecting the best investment advisors. By understanding these segments and their unique characteristics, investors can align their requirements with top-rated investment advisory firms that provide premier investment consulting services tailored to their needs.

| Segment | Description |

|---|---|

| Client Needs | Varying financial goals and risk appetites |

| Investor Profiles | Retail investors, HNIs, and institutional clients |

| Service Delivery Models | Traditional face-to-face advisory services and technology-driven platforms |

| Specialization in Asset Classes and Investment Strategies | Equities, fixed income, alternative investments |

Investment advisory services offer segmentation based on client needs, investor profiles, and service delivery models. By understanding these segments, investors can choose top-rated investment advisory firms that provide premier investment consulting services aligned with their specific requirements.

Competitive Landscape of the Investment Advisory Service Market

The investment advisory service market is highly competitive, with several top-rated investment advisory firms and leading investment management companies vying for prominence. These firms offer premier investment consulting services and are known for their expertise in providing customized investment advice tailored to meet the unique needs of their clients. Among the best investment advisors in the industry are Investor Advisory Service, TILNEY, Fidelity, Is Asset Management, Cicoc, INANI, Research And Ranking, UBS, FORSYTH BARR, and BETTER INVESTING.

These top investment advisory services differentiate themselves by offering a wide range of strategies and solutions to cater to the diverse investment goals and risk appetites of their clientele. While some firms specialize in specific asset classes or sectors, others excel in providing comprehensive portfolio management services.

The competitive landscape of the investment advisory service market is shaped by various factors. Recent developments, partnerships, mergers, and acquisitions influence the strategies and strengths of market players, enabling them to stay ahead of the curve and constantly innovate. By keeping a pulse on market trends and leveraging their expertise, these firms consistently deliver exceptional value to their clients.

Investmant Advisory Service, a top-rated investment advisory firm, states, “At the heart of our approach is a commitment to delivering superior returns while managing risk effectively. Our team of experienced advisors draws upon our extensive research capabilities and utilizes cutting-edge tools to identify investment opportunities that align with our clients’ long-term goals.”

The investment advisory service market is dynamic and ever-evolving, with the best investment advisory firms continuously striving to provide innovative solutions and personalized guidance. This competitive landscape ensures that investors have access to a wide range of premier investment consulting services, allowing them to make well-informed decisions and achieve their financial objectives.

Premium Investment Advisory Strategies Across Market Leaders

- Investor Advisory Service: This top-rated investment advisory firm has gained recognition for its top-notch research capabilities and hands-on approach to portfolio management. They offer tailored investment strategies that provide a balanced mix of growth and risk management.

- TILNEY: With a heritage that spans over 180 years, TILNEY is a leading name in the investment advisory service market. They provide comprehensive financial planning and investment management services, delivering personalized solutions to clients.

- Fidelity: As one of the largest investment management companies globally, Fidelity offers a broad range of investment solutions and premier advisory services. Their team of experts assists clients in navigating the ever-changing financial landscape.

- Is Asset Management: This firm specializes in alternative investments, aiming to generate exceptional risk-adjusted returns for their clients. With a focus on private equity and venture capital, they provide unique investment opportunities.

- Cicoc: Known for their thorough market analysis and in-depth research, Cicoc offers a range of investment advisory services. They prioritize long-term value creation and strive to align their clients’ financial goals with suitable investment strategies.

- INANI: INANI is a premier investment advisory firm that provides comprehensive financial planning and investment solutions. Their team of experts leverages their deep industry knowledge and cutting-edge tools to optimize client portfolios.

These notable market leaders exemplify the commitment to excellence and client-centric approach that sets them apart in the investment advisory service market. By offering tailored strategies, personalized guidance, and a wealth of expertise, they continue to pave the way for success in the financial services industry.

| Top Investment Advisory Firms | Key Differentiating Factors |

|---|---|

| Investor Advisory Service | Extensive research capabilities and personalized portfolio management |

| TILNEY | Comprehensive financial planning and long-standing industry expertise |

| Fidelity | Broad range of investment solutions and global presence |

| Is Asset Management | Focus on alternative investments and unique investment opportunities |

| Cicoc | Thorough market analysis and commitment to long-term value creation |

| INANI | Deep industry knowledge and cutting-edge investment tools |

These top investment advisory services continue to thrive in a highly competitive market by delivering exceptional value, personalized guidance, and innovative strategies to their clients. Investors can rely on these leading firms to navigate the complexities of the financial landscape and achieve their long-term investment goals.

The Role of Azuke Global Investment Advisory

Azuke Global Investment Advisory stands out as a provider of comprehensive and personalized financial services. Their 360-degree advisory approach covers all aspects of financial management, from portfolio management to risk assessment and retirement planning to estate management. Azuke Global Investment Advisory excels in navigating international markets and offering insights into global investment opportunities. With their cutting-edge tools and strategies, they empower clients to make informed investment decisions and optimize their returns. The team at Azuke comprises industry-leading experts dedicated to delivering exceptional results and prioritizing clients’ financial objectives.

Comprehensive Financial Management

Azuke Global Investment Advisory’s focus on comprehensive financial management sets them apart from other investment advisory services. They offer a tailored approach to each client’s financial goals, ensuring that all aspects of their wealth are managed efficiently. Whether it’s asset allocation, tax optimization, or succession planning, Azuke provides expertise and guidance in every step of the financial journey.

Through their expertise in navigating international markets, Azuke Global Investment Advisory provides clients with insights into global investment opportunities. They constantly analyze market trends and identify potential areas for growth, allowing their clients to stay ahead in the ever-changing investment landscape.

“At Azuke Global Investment Advisory, our mission is to empower our clients with the knowledge and strategies to achieve their financial objectives. We understand that each client’s financial situation is unique, and that’s why we take a personalized approach to create customized solutions that align with their goals.”

Industry-Leading Experts

The team at Azuke Global Investment Advisory comprises experienced investment professionals who possess deep knowledge of the global financial markets. Their expertise allows them to understand the unique challenges and opportunities faced by investors across different industries and regions.

With a track record of success, Azuke’s industry-leading experts have proven their ability to deliver exceptional results for their clients. They combine quantitative analysis with qualitative insights to build robust investment strategies that help clients achieve their financial objectives.

Client-Centric Approach

Azuke Global Investment Advisory prioritizes their clients’ financial objectives by maintaining a client-centric approach. They understand that each client has unique financial needs and preferences, and they tailor their services accordingly.

By building long-term relationships based on trust and transparency, Azuke Global Investment Advisory fosters an environment where clients feel comfortable discussing their financial goals and concerns. This ensures that clients receive personalized guidance and support throughout their financial journey.

The Benefits of Comprehensive Financial Management with Azuke

Comprehensive financial management is crucial for achieving long-term financial success. It involves taking a holistic approach to managing wealth, encompassing various aspects such as asset allocation, tax optimization, and succession planning.

Azuke Global Investment Advisory offers premier investment consulting services that address all these areas and ensure clients’ financial well-being. With their expertise and experience, Azuke collaborates closely with clients to create customized roadmaps that align with their unique financial goals.

By choosing Azuke as a trusted partner, clients can have peace of mind knowing that their financial future is in capable hands. Azuke’s team of best investment advisors is dedicated to providing top investment advisory services that prioritize clients’ needs and objectives.

“At Azuke, we believe in comprehensive financial management that goes beyond mere investment advice. We strive to empower our clients to make informed decisions and optimize their financial potential for a secure future.”

Azuke Global Investment Advisory stands out among leading investment management companies as a provider of comprehensive and personalized financial services. They specialize in navigating international markets and offer insights into global investment opportunities.

With Azuke as your premier investment consulting services provider, you can expect:

- Personalized financial guidance tailored to your unique needs

- Expert advice on asset allocation and risk management strategies

- Advanced tools and technologies for informed investment decision-making

- Ongoing portfolio monitoring and performance optimization

Azuke’s commitment to client-centricity and comprehensive financial management sets them apart in the industry. They constantly strive to exceed clients’ expectations and prioritize their financial objectives.

Client Success Story: Achieving Financial Goals with Azuke

Client satisfaction and success stories are testimonials to Azuke’s top-rated investment advisory services:

“Thanks to Azuke’s comprehensive financial management, I was able to navigate the complexities of the financial market and optimize my investment returns. Their tailored strategies and constant support have helped me achieve my long-term financial goals.”

– John Smith, Azuke Client

Azuke Global Investment Advisory is dedicated to empowering clients on their financial journey and helping them unlock new opportunities. Trust Azuke to guide you towards achieving your financial goals and ensuring a secure future.

Conclusion

Choosing the best investment advisory services is crucial for achieving financial success. With the complexities of financial markets and the diverse needs of investors, it is important to partner with a reputable and experienced firm. Azuke Global Investment Advisory emerges as a top choice, offering comprehensive financial services and leveraging global investment expertise.

Their commitment to client-centricity, comprehensive financial management, and industry-leading professionals sets them apart in the investment advisory service market. Azuke Global Investment Advisory understands that each client has unique goals and risk tolerance. They provide personalized investment strategies tailored to individual needs, ensuring effective asset allocation and risk management.

Trust Azuke to guide you on your financial journey, unlock new opportunities, and achieve your financial goals. As one of the top-rated investment advisory firms, they are dedicated to delivering exceptional results and helping clients navigate the ever-changing investment landscape. With Azuke, you can rest assured that your financial future is in capable hands.

FAQ

What is the role of investment advisory services?

How do investment advisory services cater to different clients?

Who are the key players in the investment advisory service market?

What sets Azuke Global Investment Advisory apart?

What are the benefits of comprehensive financial management with Azuke?

Why is it important to choose the best investment advisory services?

Source Links

- https://medium.com/@azukeglobalinvestmentadvisers/unveiling-the-essence-360-degree-advisory-services-of-azuke-global-investment-advisory-e940a57dcb65

- https://www.linkedin.com/pulse/investment-advisory-service-market-size-predictions-predicting-h1xzf

- https://www.linkedin.com/pulse/financial-investment-advisory-services-phcjf

No comments! Be the first commenter?