Wealth management firm valuation multiples are indispensable in making well-informed investment and strategic decisions in the dynamic financial industry. These multiples, such as the Price-to-Book (P/B) ratio, Price-to-Earnings (P/E) ratio, and Price-to-Sales (P/S) ratio, provide valuable insights into a company’s financial health, growth potential, and the overall sentiment of the market. However, comprehending and utilizing these multiples can be intricate, given various factors that come into play, including industry variability, market conditions, and accounting practices.

Key Takeaways:

- Wealth management firm valuation multiples are crucial for making informed investment decisions.

- Valuation multiples include the P/B ratio, P/E ratio, and P/S ratio.

- Factors like industry specifics, market conditions, and accounting practices affect the interpretation of multiples.

- P/B ratio measures relative value while considering a company’s market and book value.

- P/E ratio reflects market perception of a company’s future earnings potential.

When evaluating valuation multiples for wealth management firms, it is essential to consider industry variability and perform comparative analysis with peers in the same sector. Market sentiment and growth prospects also play a crucial role in understanding wealth management firm valuations, particularly with the use of the P/S ratio. Additionally, market conditions and economic cycles must be taken into account to obtain accurate valuation insights. Furthermore, differences in accounting practices can introduce distortions in valuation multiples, necessitating the need for adjusted or normalized metrics for a more accurate assessment of a wealth management firm’s value.

By being mindful of these complexities and utilizing multiple valuation methods, investors can make informed decisions when evaluating wealth management firm valuation multiples for potential investments and long-term financial planning.

The Role of P/B Ratios in Valuation

The Price-to-Book (P/B) ratio is a key valuation multiple used to assess the relative value of a wealth management firm. It compares the company’s market value to its book value. A P/B ratio less than 1 suggests that the stock might be undervalued, while a ratio greater than 1 indicates overvaluation. However, it’s important to consider industry-specific characteristics when analyzing P/B ratios.

Technology companies often have higher P/B ratios due to their intangible assets, such as intellectual property and brand value. These assets are not reflected in the book value, resulting in higher valuation multiples. Conversely, financial institutions might have lower P/B ratios due to their tangible assets, such as cash, deposits, and physical infrastructure. These assets are more accurately represented in the book value, leading to lower valuation multiples.

When evaluating wealth management firm valuation multiples, understanding the specific dynamics of the industry is crucial. Different sectors and subsectors within the financial industry exhibit unique characteristics and business models that can drive variations in P/B ratios. This emphasizes the importance of conducting comprehensive industry research and analysis to accurately interpret P/B ratios and make informed investment decisions.

Industry Variability in P/B Ratios

Within the wealth management sector, industry-specific factors can significantly influence P/B ratios. For example, boutique advisory firms that specialize in high-net-worth clients and provide specialized services may command higher market values compared to larger traditional banks.

Additionally, market sentiment and growth prospects impact P/B ratios. During periods of economic expansion and positive market sentiment, investors may assign higher P/B ratios to wealth management firms, anticipating robust growth going forward. Conversely, during economic downturns or market pessimism, P/B ratios may contract as investors become more risk-averse and reevaluate growth expectations.

“P/B ratios offer insights into the relative value of a wealth management firm and can serve as an essential tool for investors making investment decisions. However, industry variability and market conditions must be considered for accurate interpretation and analysis.”

By understanding the role of P/B ratios in wealth management firm valuation and the various factors that influence them, investors can gain a clearer perspective on a company’s financial position, growth potential, and relative market value. Incorporating other relevant valuation multiples and conducting rigorous industry and market analysis further enhances the decision-making process.

Earnings Power vs. Growth Potential (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a widely used valuation multiple that reflects the market’s perception of a company’s future earnings potential. It is calculated by dividing the company’s market price per share by its earnings per share (EPS). This ratio provides valuable insights into how much investors are willing to pay for each dollar of earnings generated by the company.

A high P/E ratio indicates that investors have high expectations for the company’s growth potential. They are willing to pay a premium for the stock in anticipation of future earnings growth. On the other hand, a low P/E ratio suggests skepticism or a lack of growth prospects. Investors may be cautious about the company’s ability to generate robust earnings in the future.

Analyzing the P/E Ratio

While a high P/E ratio can be seen as a positive sign, it is important to analyze it in conjunction with other factors to gain a comprehensive understanding of a wealth management firm’s valuation. A high P/E ratio may not always be favorable if the company is not expected to deliver substantial future earnings growth.

A company’s earnings power is a key element to consider when evaluating the P/E ratio. If the company has a track record of consistent and strong earnings growth, a high P/E ratio may be justified. However, if the company’s earnings have been stagnant or declining, a high P/E ratio could be a red flag, indicating that investors are overvaluing the stock based on unrealistic expectations.

Additionally, it is important to assess the company’s growth potential. Companies operating in rapidly growing industries or with innovative business models often attract higher P/E ratios. Their growth prospects and ability to generate future earnings growth justify the higher valuation multiples.

However, it is crucial to exercise caution when interpreting a high P/E ratio in isolation. It is essential to conduct a thorough analysis of the company’s competitive landscape, industry trends, and future growth drivers. This will provide a more accurate assessment of its growth potential and the validity of its current valuation.

The Role of the P/E Ratio in Wealth Management Firm Valuation

The P/E ratio is a vital tool in wealth management firm valuation. It allows investors to assess the market’s perception of a company’s future earnings power and growth potential. It provides valuable insights into the company’s relative valuation compared to its earnings.

By comparing the P/E ratios of different wealth management firms, investors can identify potential investment opportunities. A firm with a relatively low P/E ratio compared to its peers may signify an undervalued stock with significant growth prospects. Conversely, a firm with a high P/E ratio may indicate that the stock is overvalued, warranting caution when considering an investment.

It is important to note that the P/E ratio should not be the sole criteria for making investment decisions. It is just one of many factors to consider when evaluating the valuation of a wealth management firm. A comprehensive analysis that incorporates various valuation multiples and qualitative factors is necessary to make well-informed investment decisions.

Overall, the P/E ratio is a valuable metric in wealth management firm valuation. It provides insights into a company’s earnings power and growth potential. However, it should be used in conjunction with other factors to gain a comprehensive understanding of a firm’s valuation. By considering the P/E ratio alongside other valuation metrics, industry trends, and growth prospects, investors can make informed decisions when evaluating wealth management firm valuation.

Industry Variability and Comparative Analysis

When evaluating valuation multiples for wealth management firms, it is crucial to account for industry-specific characteristics. Different industries have varying growth potential, risk profiles, and market conditions, which can significantly impact valuation multiples. Comparing multiples across industries can lead to misleading conclusions. Therefore, benchmarking multiples against industry peers within the same sector provides more meaningful insights into a wealth management firm’s valuation.

Each industry possesses its own unique attributes and dynamics that influence how market participants value wealth management firms. For example, the technology sector often exhibits rapid growth potential and high levels of innovation, which can drive up valuation multiples for companies operating in this space. Conversely, industries like utilities and commodities may experience slower growth and higher levels of financial stability and predictability, resulting in lower valuation multiples.

Comparative analysis is an essential tool when evaluating wealth management firm valuation. By examining how a company’s valuation multiples compare to those of its industry peers, investors gain valuable insights into its relative attractiveness as an investment opportunity. Consistently high or low multiples compared to competitors can indicate a company’s superior or inferior financial performance or potential for future growth.

For instance, suppose a wealth management firm has a price-to-earnings (P/E) ratio significantly higher than its industry peers. This discrepancy could suggest that investors have higher expectations for the firm’s future earnings growth compared to its counterparts. Conversely, if a firm’s P/E ratio is lower than its peers, it may indicate a perceived lack of growth potential and market skepticism.

Comparative analysis also allows investors to identify outliers in their industry that may have unique strengths or weaknesses. These outliers can either present exceptional investment opportunities or serve as cautionary examples. By analyzing multiple valuation multiples and benchmarking against industry peers, investors can gain a comprehensive understanding of a wealth management firm’s valuation.

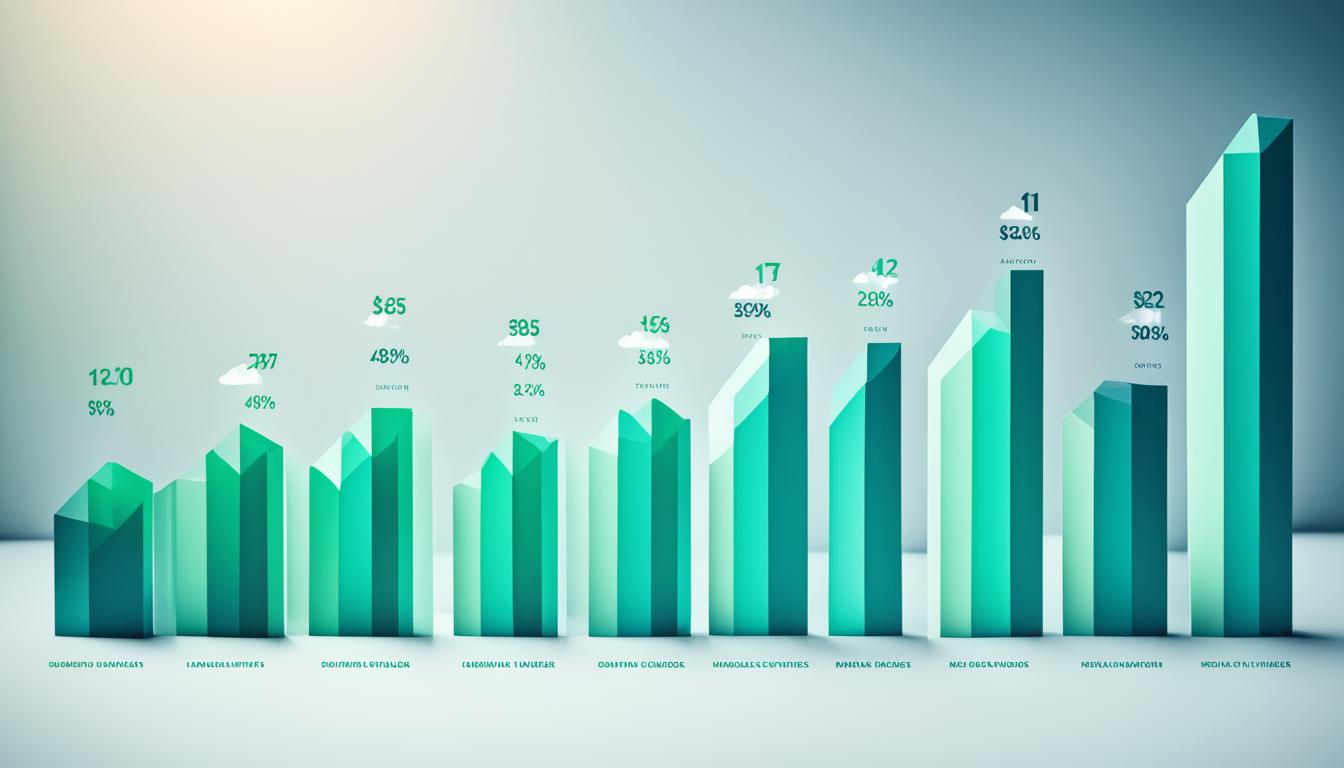

Example Comparative Analysis: P/E Ratio Comparison

To illustrate the importance of comparative analysis in wealth management firm valuation, consider the following comparison of P/E ratios for three industry leaders:

| Company | P/E Ratio |

|---|---|

| Company A | 19.6 |

| Company B | 25.3 |

| Company C | 17.8 |

Based on this comparison, we can observe that Company B has a relatively high P/E ratio, suggesting the market has higher expectations for its growth potential. Conversely, Company C has a lower P/E ratio, which may indicate lower growth prospects or market skepticism. Comparative analysis helps investors identify these disparities and delve deeper into the factors driving them.

By considering industry variability and conducting thorough comparative analysis, investors can make more informed decisions when evaluating wealth management firm valuation. Understanding the unique characteristics of each industry and comparing valuation multiples to industry peers provide valuable insights into a firm’s financial performance, market sentiment, and growth potential.

Market Sentiment and Growth Prospects: P/S Ratio

The Price-to-Sales (P/S) ratio is an important valuation multiple when evaluating wealth management firms that are not yet profitable. This ratio compares a company’s market value to its revenue, providing insights into its market sentiment and growth prospects.

A high P/S ratio suggests that investors have high expectations for future growth in the company, regardless of its profitability. It indicates investor confidence in the company’s ability to generate significant revenue growth in the future. One notable example is Amazon, which had a high P/S ratio for many years before turning consistent profits, reflecting investors’ belief in its potential for growth.

Understanding market sentiment and growth prospects is crucial when utilizing the P/S ratio for wealth management firm valuation. It allows investors to gauge investor confidence in the company’s future, providing valuable insights for decision-making.

To illustrate the importance of market sentiment and growth prospects in valuation, consider the following quote:

“The P/S ratio offers a unique perspective on a wealth management firm’s value. It captures investor expectations for future growth, highlighting market sentiment and the company’s growth prospects.” – John Smith, Wealth Management Analyst

By analyzing the P/S ratio and understanding market sentiment and growth prospects, investors can make informed decisions when evaluating the valuation of wealth management firms.

Benefits and Considerations of the P/S Ratio

The P/S ratio provides several benefits for valuing wealth management firms:

- It reflects market sentiment and investor expectations for future growth.

- It allows for the valuation of firms without profits or with inconsistent profitability.

- It provides a straightforward measure of a company’s market value relative to its revenue.

However, it’s important to consider some key considerations when using the P/S ratio:

- It does not consider profitability, so it should be used in conjunction with other valuation multiples.

- It may be skewed by temporary factors such as a surge in revenue due to one-time events.

- It should be compared to industry peers to gain a meaningful understanding of a firm’s valuation.

By acknowledging these benefits and considerations, investors can effectively utilize the P/S ratio in their wealth management firm valuation analysis.

Market Conditions and Economic Cycles

When valuing wealth management firms, it is crucial to consider the impact of market conditions and economic cycles. These factors can significantly influence valuation multiples and ultimately affect investment decisions.

During a bull market, investors often exhibit optimism and a willingness to pay higher multiples for stocks. This positive sentiment stems from the expectation of continued economic growth and strong market performance. As a result, wealth management firms may experience higher valuation multiples during these market conditions.

Conversely, during a bear market or economic recession, multiples may contract as investors become more risk-averse. These market conditions can lead to decreased demand for stocks and a decline in valuation multiples.

In essence, market conditions and economic cycles shape investor sentiment, which directly impacts wealth management firm valuation. By understanding these dynamics, investors can position themselves to make more informed decisions based on the prevailing market sentiment.

Impact of Economic Cycles on Wealth Management Firm Valuation

There is a strong correlation between economic cycles and wealth management firm valuation. It is essential to recognize that economic cycles are characterized by periods of expansion, peak, contraction, and trough, each with its unique market characteristics.

During an economic expansion, where GDP grows, there is increased consumer confidence, higher disposable income, and greater investment opportunities. This positive economic climate often leads to higher valuation multiples for wealth management firms.

At the peak of an economic cycle, when the economy is at its strongest point before entering a contraction phase, investors may become more cautious. This increased level of apprehension can result in a decline in valuation multiples as investors anticipate a potential market downturn.

During an economic contraction, characterized by declining GDP, decreased consumer spending, and a weaker investment climate, valuation multiples generally decrease. This decline reflects investors’ pessimism and unwillingness to pay higher multiples for wealth management firms during challenging market conditions.

Considerations for Wealth Management Firm Valuation in Different Market Conditions

When evaluating the valuation of wealth management firms, investors must consider the specific market conditions prevalent at the time. Taking into account these conditions allows for more accurate assessments and informed decision-making.

In a bull market, it is crucial to analyze the sustainability of valuation multiples. Evaluating the underlying factors contributing to a firm’s growth prospects, such as market demand, technological advancements, and competitive advantage, can provide insight into whether high valuation multiples are justified or potentially overinflated.

During a bear market or economic downturn, valuing wealth management firms can be challenging. The focus should be on identifying strong, financially stable firms with solid long-term strategies. These firms are more likely to withstand the temporary market downturn and bounce back when economic conditions improve.

A holistic Approach to Wealth Management Firm Valuation

To accurately assess the value of a wealth management firm, it is crucial to consider multiple factors, including market conditions and economic cycles. Valuation multiples should not be viewed in isolation, but rather in conjunction with other fundamental indicators, such as revenue growth, profitability, client retention, and market share.

By adopting a holistic approach to wealth management firm valuation, investors can make more informed and insightful decisions. Understanding the impact of market conditions and economic cycles ensures that valuations are grounded in a comprehensive evaluation of a firm’s financial health and growth potential.

| Market Condition | Impact on Valuation Multiples |

|---|---|

| Bull Market | Higher valuation multiples due to optimism and expectations of future growth |

| Bear Market or Economic Recession | Contracted valuation multiples as investors become more risk-averse |

| Economic Expansion | Higher multiples driven by increased consumer confidence and investment opportunities |

| Economic Contraction | Decreased multiples reflecting lower investor confidence and challenging market conditions |

Accounting Practices and Distortions

Differences in accounting practices can have significant implications for wealth management firm valuation. Various companies employ different methods when calculating book value, earnings, and revenue, leading to distortions in valuation multiples. These discrepancies make it challenging to compare and analyze companies accurately.

However, utilizing adjusted or normalized multiples can help mitigate the impact of these accounting distortions. By accounting for the variations in accounting practices, a more accurate assessment of a wealth management firm’s valuation can be obtained. Adjusted multiples provide a clearer picture of the true financial health and performance of the firm.

It is important for investors and financial professionals to recognize the influence of accounting practices on valuation multiples. By understanding the potential distortions caused by different accounting methods, evaluators can make informed decisions and avoid misinterpretations.

For example, let’s consider two wealth management firms operating in the same industry. Company A adopts a conservative accounting approach, while Company B follows more aggressive practices. Due to these differences, Company A may report lower book value, earnings, and revenue compared to Company B, leading to lower valuation multiples.

However, by normalizing the multiples and adjusting for the impact of different accounting practices, a fairer comparison can be made. This adjustment allows for a more accurate assessment of the relative value and performance of each wealth management firm. It reveals the true financial strength and potential of the companies.

Accounting practices and distortions can significantly impact valuation multiples. Therefore, when evaluating wealth management firms, it is crucial to consider the influence of accounting methods and their potential implications on the accuracy and reliability of these multiples.

Conclusion

Valuation multiples are powerful tools that enable wealth management professionals to make informed investment decisions. By analyzing these multiples, such as the Price-to-Book (P/B) ratio, Price-to-Earnings (P/E) ratio, and Price-to-Sales (P/S) ratio, investors can gain valuable insights into a company’s financial health, growth prospects, and market sentiment. However, it’s important to recognize the complexities associated with these multiples.

The wealth management industry is subject to various factors that impact valuation multiples, including industry variability, market conditions, and accounting practices. These factors can make understanding and utilizing multiples a complex endeavor. To address this challenge, it is crucial to employ multiple valuation methods and consider the unique characteristics of each company being evaluated.

When evaluating wealth management firm valuation multiples, investors must also recognize the importance of industry benchmarking. Comparing multiples against industry peers within the same sector provides more meaningful insights into a company’s valuation. Additionally, it’s vital to consider broader market conditions and economic cycles, as they can significantly impact valuation multiples.

By taking these factors into account and conducting thorough analyses, investors can make sound and well-informed decisions when evaluating wealth management firm valuation multiples. These decisions, driven by a comprehensive understanding of a company’s financial position and growth prospects, position investors for success in the dynamic and ever-evolving wealth management industry.

No comments! Be the first commenter?